What is cyber insurance?

Cyber insurance protects businesses and individuals against financial losses and liability related to cyber threats such as data breaches, cyberattacks, and hacking incidents. Cover typically includes expenses for responding to and recovering from a breach, such as the cost of hiring a forensic firm to investigate the breach, notifying affected customers, and providing credit monitoring services. It may also provide cover for expenses related to legal actions such as lawsuits, regulatory fines, and compensation to customers whose personal information was stolen.

Why is it important?

Apart from vital financial and legal cover, cyber insurance also provides access to resources and support to help mitigate the damage and prevent similar incidents from happening in the future. With the increasing frequency and severity of cyberattacks, it’s becoming an essential part of a comprehensive risk management strategy.

Why should organisations buy cyber insurance?

It may feel like another unnecessary expense, but should be considered for the following reasons:

- Financial Protection: Cyber insurance provides financial protection against the costs associated with a cyberattack or data breach. This may mean covering the costs of restoring lost or stolen data, repairing damaged computer systems, and compensating for any liability from a security breach.

- Compliance: Many industries are subject to regulations requiring companies to have certain security measures in place; having cyber insurance can help meet these requirements.

- Reputation: Cyberattacks can damage a business’ reputation, leading to loss of customers and revenue. Cyber insurance can help offset these costs and assist with crisis management and reputation repair.

- Access to Expertise: Cyber insurance policies often include access to cybersecurity experts who can help businesses respond to and recover from a cyber incident, reducing the impact on the business.

- Peace of Mind: Should the worst happen help is at hand, allowing business owners to focus on running their business.

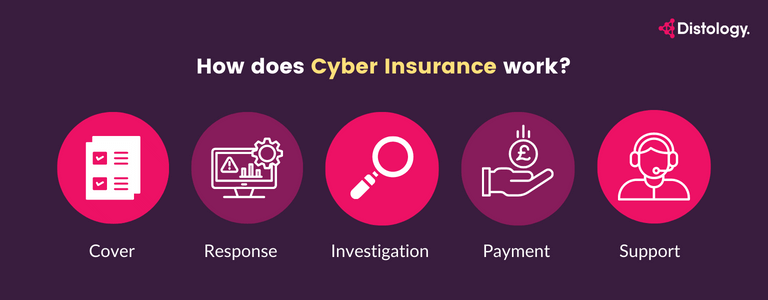

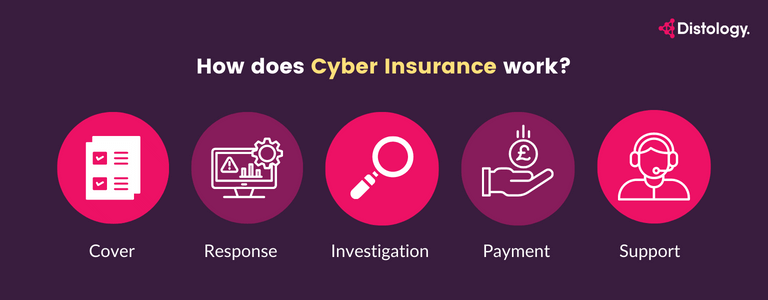

How does it work?

Cyber insurance works by providing financial protection and support for businesses and individuals in the event of a cyberattack or data breach. Here’s how it typically works:

- Cover: The policyholder purchases cover that outlines the types of cyber incidents the policy will cover, such as data breaches, hacking, and extortion.

- Incident Response: In the event of a cyberattack, the policyholder will report the incident to their insurance provider and the provider will initiate the incident response process.

- Investigation: The insurance provider will investigate the incident to determine the extent of the damage and costs associated with response and recovery.

- Payment: Based on the investigation and the terms of the policy, the insurance provider will pay out the cover amount to the policyholder to help cover the costs of the incident.

- Post-Incident Support: The insurance provider may also provide post-incident support, such as access to crisis management experts, data breach response and recovery services, and credit monitoring for affected individuals.

By purchasing cyber insurance, businesses can have access to the financial resources and expertise needed to respond to and recover from an attack, helping minimise the impact on the business.

How can insurance premiums be minimised?

Insurance providers assess how ‘risky’ a business is in order to determine the cost of the premium; in this case they will look at their cybersecurity strategy and maturity. By proving the right policies, processes and technology are in place, premiums can sometimes be reduced as well as inherently increasing the chances of being insured in the first place. Technologies such as multi-factor authentication, vulnerability assessments and log management will all play a part in mitigating risk.

Is cyber insurance mandatory?

It is not mandatory in the UK, but it is strongly recommended by the government and industry organisations. The UK government has encouraged organisations of all sizes to take out insurance to protect against the growing threat of cyberattacks and data breaches.

Some industries, such as finance and healthcare, may be subject to regulations that require companies to have certain security measures in place along with cyber insurance. Additionally, organisations may need it if they handle sensitive customer data or are subject to data protection laws, such as the EU General Data Protection Regulation (GDPR).

Is cyber insurance worth it?

Yes, for businesses and individuals that rely on technology and sensitive data in their operations the cost of an attack or data breach can be significant.

Here are some factors to consider when determining if cyber insurance is worth it:

- Risk: The level of risk a business or individual faces from cyberattacks and data breaches will influence the need for cyber insurance. Businesses that handle sensitive customer data, such as financial information, are at a higher risk and may benefit from the added protection.

- Cost: Costs vary depending on the cover purchased and the size of the business. It’s important to consider the cost of the insurance premium in relation to the potential financial losses from a cyberattack.

- Compliance: Some industries are subject to regulations requiring companies to have certain security measures in place. Not having insurance in place may mean companies cannot work with certain organisations such as the UK Government.

- Resources: Access to the resources and expertise that some cyber insurance provides can be especially valuable to businesses that don’t have internal resources to handle a cyber incident. Ultimately, whether cyber insurance is worth it will depend on the specific needs and circumstances of the business or individual. It’s important to carefully consider the potential risks and benefits when deciding.

Cyber insurance requirements for 2023

Starting in 2023, companies will be required to comply with new cybersecurity regulations aimed at protecting against cyber threats. Among the new requirements, multi-factor authentication (MFA) will be a critical measure to secure access to sensitive data and systems. MFA adds an additional layer of security to logins, requiring users to provide two or more pieces of evidence to verify their identity. This can include something the user knows, like a password or PIN, and something the user has, like a security token or a fingerprint. MFA is widely considered one of the easiest changes to implement, but it can significantly reduce the risk of a data breach. In fact, studies have shown that MFA can prevent up to 99.9% of account compromise attacks.

In addition to implementing MFA, companies can also benefit from obtaining cybersecurity certifications such as Cyber Essentials and ISO 27001 or adhering to the NIST framework. This demonstrates that a company has implemented robust cybersecurity measures and has taken steps to mitigate cyber risks. Cyber insurance companies often look favourably on companies that have obtained certifications, as they indicate that the company has taken proactive measures to protect their data and systems.

Additionally, some cyber insurance policies may offer more beneficial terms and conditions as well as offer lower premiums or higher coverage limits. By obtaining cybersecurity certifications or using frameworks as a guide, companies can not only strengthen their security posture and comply with regulations, but also potentially reduce their cyber insurance costs.

Cyber insurance vs cybersecurity: what’s the difference?

Cyber insurance and cybersecurity are related but distinct concepts.

Cybersecurity refers to the measures and technologies used to protect against cyberattacks, data breaches, and other online threats. Practices such as network security, data encryption, and user awareness training are all cybersecurity measures to help prevent and mitigate cyber incidents. In short, cybersecurity is about preventing cyber incidents, while cyber insurance is about managing the impact of those incidents if they do occur. Both are important components of a comprehensive risk management strategy for organisations that rely on technology and sensitive data in their operations.